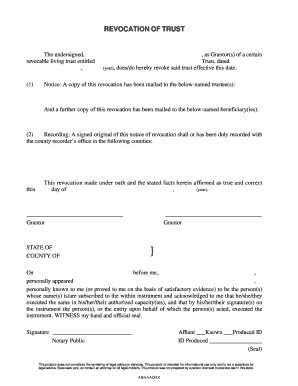

Get the free trust dissolution form

Show details

Agreement Among Beneficiaries to Terminate TrustAgreement made on the (date), between (Name of Beneficiary A) of (street address, city, county, state, zip code), referred to herein as Beneficiary

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign termination of trust form

Edit your trust dissolution form template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dissolution of trust form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing agreement trust template online

Follow the steps down below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit how to close a trust form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out trust dissolution form pdf

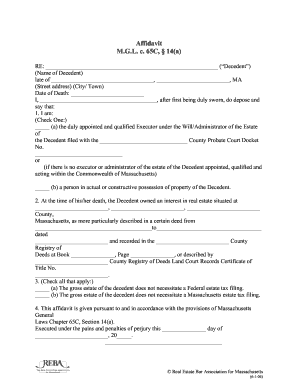

How to fill out US-01208BG

01

Obtain the US-01208BG form from the official website or the designated office.

02

Start by entering your personal information at the top of the form, including your name, address, and contact details.

03

Fill out the section regarding your employment status, including your employer's name and address.

04

Complete any required financial information, providing accurate figures as requested.

05

Ensure to review any additional documentation required to accompany the form.

06

Sign and date the form at the designated area.

07

Submit the completed form by the specified method, whether by mail, in-person, or electronically.

Who needs US-01208BG?

01

Individuals applying for a specific government program or service that requires the US-01208BG form.

02

People undergoing a review process for benefits or entitlements.

03

Applicants needing to verify their eligibility for financial assistance programs.

Fill

agreement terminate

: Try Risk Free

People Also Ask about sample termination of trust

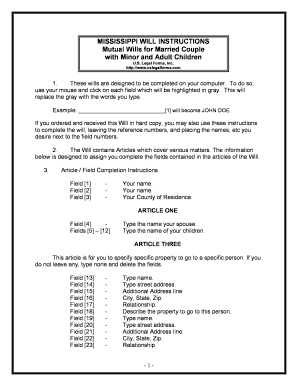

How do you close a family trust?

The settlor or the trustee can close a family trust by revoking it if the trust deed gives them the power to do so. The trust deed will set out the process for the settlor or trustee to revoke the trust. You will need to formally record the revocation of the trust, and make the records available to the beneficiaries.

How does dissolving a trust affect tax?

No, dissolving your revocable trust would not be a taxable event. You should be using one of your social security numbers for the revocable trust, so moving the funds from the trust to new transfer on death (TOD) accounts should be no different from moving money from accounts in your own names.

How long does it take to dissolve a family trust?

When is a family trust dissolved? A family trust automatically winds up 80 years from the date of the trust deed, or a date specified in the trust deed (this is called the distribution date).

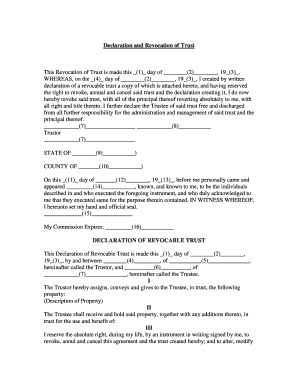

How can a trust be dissolved?

Dissolution of trust If there is a certain prescribed period in a trust deed, the trust relationship will be valid until that period and will end after such a period. If the property gets used for a purpose other than the one for which trust is made, the trust comes to an end.

What happens when a trust dissolves?

Once a trust is dissolved, trust assets are distributed as the founder sees fit. This can mean distributing assets among the trust's beneficiaries, reclaiming the assets for themselves or some combination of the two. With irrevocable trusts, no party can unilaterally break the trust. This includes the trust's founder.

How long does it take for money to be distributed from a trust?

Most Trusts take 12 months to 18 months to settle and distribute assets to the beneficiaries and heirs. What determines how long a Trustee takes will depend on the complexity of the estate where properties and other assets may have to be bought or sold before distribution to the Beneficiaries.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in agreement trust sample?

With pdfFiller, it's easy to make changes. Open your revocation of trust in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I edit terminate irrevocable trust form on an iOS device?

You certainly can. You can quickly edit, distribute, and sign petition to terminate trust on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How can I fill out trust termination form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your living trust forms online. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is US-01208BG?

US-01208BG is a specific form or document used for reporting or compliance purposes in the United States.

Who is required to file US-01208BG?

Individuals or entities specified by regulatory guidelines or laws, typically those involved in activities that require such reporting.

How to fill out US-01208BG?

Fill out US-01208BG by providing the required information in each section, following the instructions provided on the form.

What is the purpose of US-01208BG?

The purpose of US-01208BG is to collect specific information for regulatory, tax, or compliance purposes.

What information must be reported on US-01208BG?

The form typically requires details such as identity information, financial data, and any other specifics mandated by the reporting authority.

Fill out your US-01208BG online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Agreement To Terminate Trust Form is not the form you're looking for?Search for another form here.

Keywords relevant to termination of trust document

Related to trust revocation form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.